The UK base rate, set by the Bank of England (BoE), is a pivotal element in the nation’s financial landscape. It influences the cost of borrowing, the value of savings, and the overall health of the economy. For businesses, individuals, and policymakers, understanding how the UK base rate functions and its implications is essential. In recent years, the role of Artificial Intelligence (AI) in predicting and analyzing base rate changes has further highlighted the evolving nature of economic analysis and decision-making.

1. What is the UK Base Rate?

The UK base rate is the interest rate set by the Bank of England. This rate serves as a benchmark for the cost of borrowing money within the country. When the BoE sets the base rate, it affects the interest rates that banks charge their customers on loans and mortgages, as well as the returns they offer on savings accounts. Essentially, the base rate influences the overall financial atmosphere in the UK.

READ ALSO: Theonionnews.co.uk

1.1. Why is the UK Base Rate Important?

The UK base rate is a powerful monetary policy tool that the Bank of England uses to control inflation and stabilize the economy. When inflation is rising too quickly, the BoE may raise the base rate to curb spending and borrowing, thereby cooling down the economy. Conversely, when the economy is in a downturn, the BoE might lower the base rate to encourage borrowing and spending, stimulating growth.

Changes in the UK base rate can affect:

- Interest rates on loans and mortgages: A rise in the base rate usually leads to an increase in the cost of borrowing, impacting individuals and businesses alike.

- Savings rates: Banks tend to offer higher returns on savings when the base rate is higher, encouraging people to save more.

- Exchange rates: Changes in the UK base rate can influence the value of the British pound in global currency markets.

2. How the UK Base Rate is Determined

The Bank of England’s Monetary Policy Committee (MPC), an independent body, meets approximately eight times a year to review and potentially adjust the UK base rate. The MPC consists of nine members, including the Governor of the BoE and experts on monetary policy. Their decisions are based on economic indicators such as inflation, unemployment rates, economic growth, and external factors affecting the UK economy.

2.1. The Role of Artificial Intelligence in Base Rate Analysis

AI technologies have revolutionized the way financial institutions analyze and forecast changes in the UK base rate. By employing machine learning algorithms, the BoE and other financial entities can assess a large volume of economic data, identify trends, and even simulate different policy scenarios. This advanced use of AI is reshaping the landscape of economic analysis.

For instance, machine learning models can identify patterns in inflation and GDP data, allowing analysts to anticipate changes in the UK base rate with higher accuracy. This predictive capability helps businesses and investors make more informed decisions regarding investments, borrowing, and risk management.

3. Historical Trends in the UK Base Rate

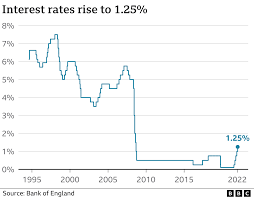

The UK base rate has experienced significant fluctuations over the decades, reflecting shifts in the economic environment and policy priorities. During the 1980s, for example, the base rate reached double digits as the BoE sought to combat high inflation. In contrast, following the 2008 financial crisis, the base rate dropped to historic lows to stimulate economic recovery.

3.1. Recent Developments and the Impact of Brexit and COVID-19

Two major events have dramatically affected the UK economy in recent years—Brexit and the COVID-19 pandemic. These events have prompted the BoE to adopt a cautious approach to base rate changes.

- Post-Brexit Era: After the UK’s departure from the European Union, uncertainty over trade agreements and financial stability led the BoE to keep interest rates low to support economic resilience.

- COVID-19 Crisis: During the pandemic, the BoE slashed the UK base rate to an unprecedented 0.1% in 2020 to support businesses and individuals facing financial difficulties.

4. Implications of Changes in the UK Base Rate

Changes in the UK base rate ripple through the economy, affecting various aspects of society. Understanding these implications is essential for making informed financial decisions.

4.1. Impact on Households and Borrowers

When the UK base rate rises, the cost of borrowing increases. This has a direct effect on households with variable-rate mortgages, personal loans, or credit card debt. For example, if the BoE raises the base rate, homeowners with tracker mortgages may face higher monthly payments, straining household budgets.

On the flip side, a higher base rate benefits savers by providing higher returns on savings accounts. This encourages people to save more, potentially reducing their spending in the economy.

4.2. Impact on Businesses and Investments

For businesses, changes in the UK base rate can affect the cost of financing. Higher interest rates increase the cost of business loans, making it more expensive for companies to invest in growth or expansion. Conversely, when the base rate is low, businesses may be more inclined to borrow and invest in new projects, leading to economic growth.

Investors also monitor changes in the base rate closely, as it affects stock prices, bond yields, and real estate investments. A higher base rate may lead to a shift in investor preferences towards safer assets like bonds, impacting stock market performance.

5. The Role of AI in Predicting the Future of the UK Base Rate

Artificial Intelligence is playing a growing role in predicting future changes in the UK base rate. Advanced AI models can analyze a wide range of economic indicators and identify hidden correlations that human analysts might miss. These AI-driven insights are helping financial institutions and policymakers make more accurate forecasts and better-informed decisions.

5.1. AI in Economic Forecasting

AI algorithms are capable of processing massive datasets, including inflation rates, employment figures, consumer spending patterns, and global economic trends. By analyzing these variables, AI systems can provide valuable insights into the likelihood of base rate changes.

For example, central banks around the world, including the BoE, are exploring the use of natural language processing (NLP) to analyze public sentiment from news articles, social media, and financial reports. NLP can gauge public perception of economic stability and potential risks, providing a more nuanced understanding of market conditions.

6. Future Outlook for the UK Base Rate

As the UK economy faces challenges such as global economic uncertainty, climate change, and geopolitical tensions, the future direction of the UK base rate remains a key concern for businesses and individuals. While AI can provide valuable insights, the decisions ultimately rest with policymakers at the Bank of England.

6.1. Key Factors Influencing the UK Base Rate

Several factors will play a role in shaping future changes in the UK base rate, including:

- Inflation: The BoE’s primary mandate is to keep inflation within a target range. Persistent inflationary pressures may force the BoE to raise the base rate to maintain price stability.

- Economic Growth: If the UK economy shows signs of stagnation or contraction, the BoE may opt for lower interest rates to encourage borrowing and investment.

- Global Economic Conditions: External factors such as global trade dynamics, supply chain disruptions, and geopolitical tensions can influence the UK’s economic landscape and impact base rate decisions.

6.2. The Role of AI in Shaping Policy Decisions

As AI technologies continue to advance, their integration into economic analysis and policy-making is likely to deepen. AI-driven insights can enhance the BoE’s understanding of complex economic phenomena and provide early warnings of potential risks. However, human judgment remains crucial in interpreting these insights and making well-rounded policy decisions.

Conclusion

The UK base rate is a cornerstone of the nation’s monetary policy, with far-reaching effects on individuals, businesses, and the broader economy. As the BoE navigates the complexities of inflation, economic growth, and external pressures, the integration of Artificial Intelligence into economic analysis is becoming increasingly significant. AI-driven models offer the potential for more accurate predictions and better-informed policy decisions, helping to steer the UK economy through uncertain times.

In a world where technology and economics are increasingly intertwined, the continued evolution of AI in understanding and predicting changes in the UK base rate promises a new era of data-driven decision-making. For policymakers, businesses, and individuals alike, keeping a close eye on the base rate and harnessing the power of AI will be key to navigating the economic landscape of the future.